In todays blog post we will be talking about Cash Advance Apps that Work With Chime. Hey there! Life can be a bit tricky, especially when money matters get a bit tight before payday. But guess what? You’re not alone, and there’s a digital squad ready to help you out – all thanks to cash advance apps that work with Chime.

In this blog post, we’re going to talk about these cool apps that make handling money stuff super easy. Imagine being able to get some extra cash with just a few taps on your phone – no waiting, no fuss. It’s like having a superhero for your wallet!

So, stick around as we chat about these apps that play nice with Chime. We’ll keep it simple, no fancy jargon – just the lowdown on how you can get the cash you need without stress. From early paycheck access to no-fee overdrafts, we’ll cover it all. By the end, you’ll be a pro at handling your money, and you might even have a favorite cash app or two. Ready? Let’s dive in!

12 Top Cash Advance Apps Compatible with Chime

Chime, a popular neobank, doesn’t offer traditional cash advances itself. However, fear not! Several third-party apps seamlessly integrate with Chime, providing convenient access to funds when you need them most. Here are 12 top options, each with its unique strengths:

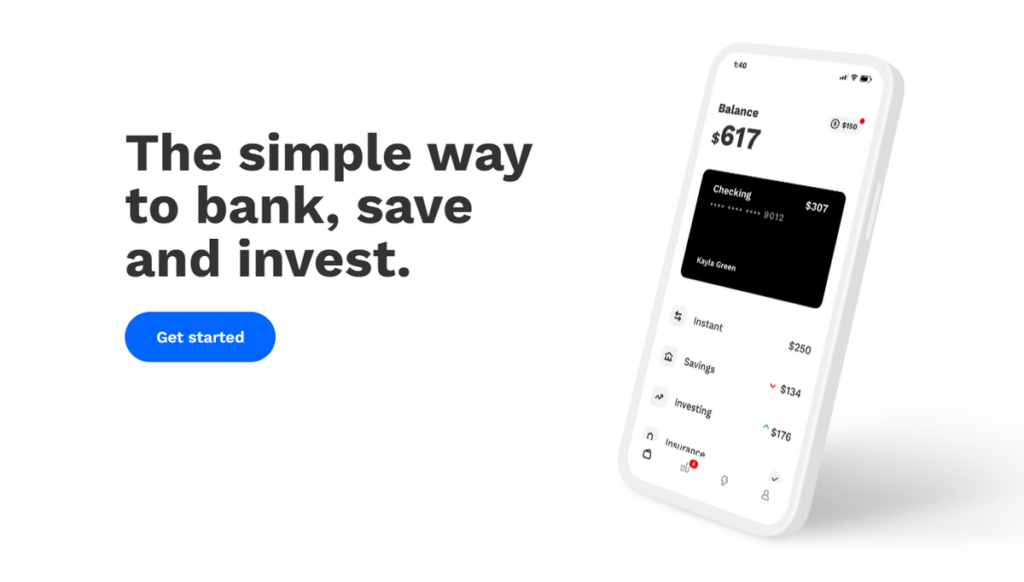

1. Chime SpotMe

Chime SpotMe is a financial feature that acts as a friendly safety net for Chime users, offering a cushion for those times when your balance is running low. It’s like having a trustworthy friend who’s got your back, ensuring you avoid those pesky overdraft fees.

Best Features:

- Best for: Overdraft protection without fees (up to $200)

- Features: Early access to direct deposits, budgeting tools, spending insights

- Eligibility: Chime checking account with direct deposits

- Fees: None for overdrafts up to your limit, standard fees for exceeding the limit

2. Albert

Albert is not a cash advance app itself; rather, it is a comprehensive financial app that provides users with a range of tools to manage their money wisely. Albert’s main goal is to offer personalized financial advice and assistance to help users achieve their financial goals.

Best Features:

- Best for: All-in-one financial app with cash advances

- Features: Cash advances up to $250, budgeting tools, investment advice, subscription monitoring

- Eligibility: Valid US Social Security number, US bank account, and valid government-issued ID

- Fees: Monthly membership fee ($3-$4), optional tips for cash advances

3. Brigit

Brigit is a financial app designed to help users manage their cash flow and avoid overdrafts. It acts as a proactive financial assistant, providing users with tools to stay on top of their expenses and bridge the gap between paychecks.

Best Features

- Best for: Flexible repayment options on cash advances

- Features: Cash advances up to $250, auto-advance based on spending patterns, budgeting tools, credit builder

- Eligibility: Valid US Social Security number, US bank account, and valid government-issued ID

- Fees: Monthly membership fee ($9.99), optional tips for cash advances

4. MoneyLion

MoneyLion is a comprehensive financial platform that combines banking, investing, and personal finance tools to provide users with a holistic approach to managing their money. With a focus on accessibility and inclusivity, MoneyLion aims to empower users, offering a range of features to enhance their financial well-being.

- Best for: Full banking experience with cash advances

- Features: Cash advances up to $250, checking and savings accounts, debit card, credit builder, investment options

- Eligibility: Valid US Social Security number, US bank account, and valid government-issued ID

- Fees: Monthly membership fee ($1-$19.99), potential loan origination fees for advances

5. Opploans

OppLoans is a financial institution that specializes in providing accessible and affordable installment loans to individuals in need of short-term financial assistance. Unlike traditional payday loans, OppLoans emphasizes transparency and responsible lending practices.

Best Features

- Best for: Larger installment loans

- Features: Loans from $500 to $4,000, repayment terms up to 18 months, credit building tools

- Eligibility: Valid US Social Security number, US bank account, and valid government-issued ID

- Fees: Interest rates vary depending on creditworthiness and loan terms

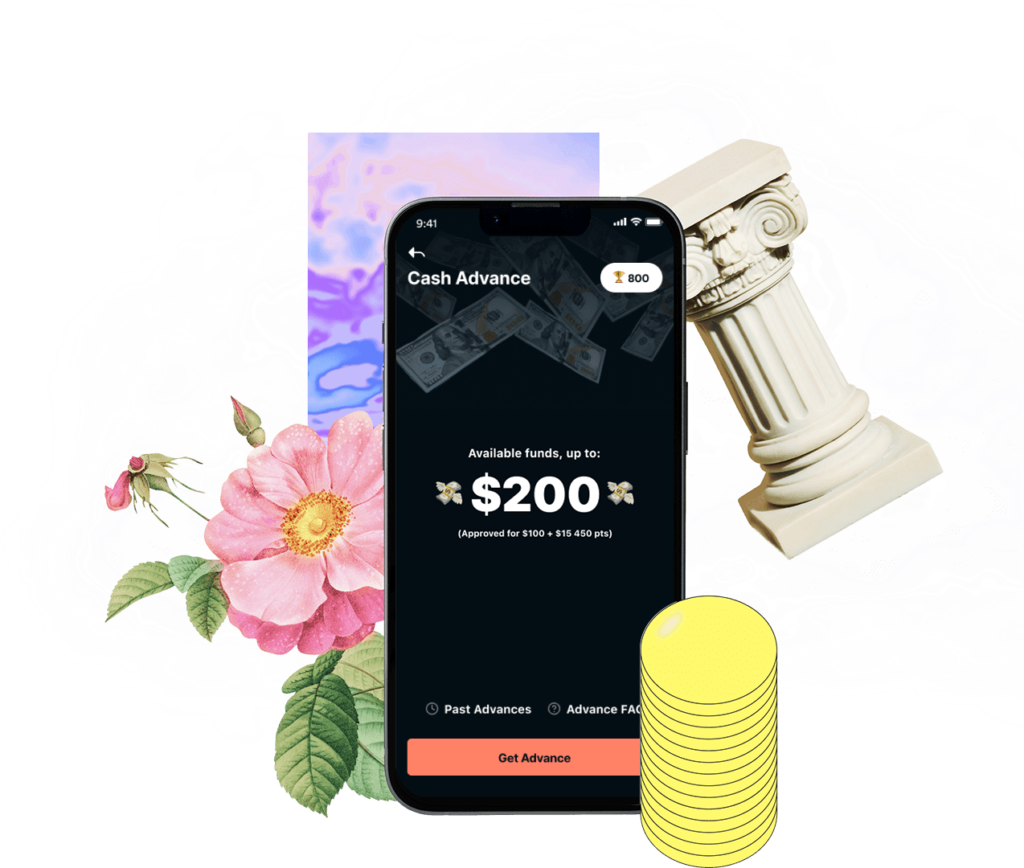

6. Dave

Dave is a financial app that aims to empower users with tools to better manage their money, avoid overdrafts, and achieve their financial goals. Designed to be user-friendly, Dave offers a range of features that go beyond traditional banking services.

Best Features:

- Best for: Overdraft protection and budgeting tools

- Features: “ExtraCash” advances up to $500, budgeting tools, spending insights, “Early Pay” for accessing a portion of your paycheck early

- Eligibility: Valid US Social Security number, US bank account, and valid government-issued ID

- Fees: Monthly membership fee ($1), optional tips for advances

7. Branch

Branch is a financial app that offers a suite of services to help users manage their money, access instant cash advances, and gain insights into their spending habits. Tailored to meet the needs of users looking for quick financial solutions, Branch combines convenience with smart features.

Best Features

- Best for: Budgeting tools and credit monitoring

- Features: Cash advances up to $500, budgeting tools, credit monitoring, financial coaching

- Eligibility: Valid US Social Security number, US bank account, and valid government-issued ID

- Fees: Monthly membership fee ($13.99), potential transaction fees

8. Klover

Klover is a financial app that provides users with early access to their earned wages, as well as budgeting tools and credit building resources.

- Best for: Credit building tools and job search assistance

- Features: Cash advances up to $100, credit builder, budgeting tools, job search resources

- Eligibility: Valid US Social Security number, US bank account, and valid government-issued ID

- Fees: Monthly membership fee ($4.99), potential transaction fees

9. Earnin

Earnin is a financial app specializing in early access to your earned wages,

- Best for: Early access to earned wages

- Features: Access up to $100 of your earned wages before payday, budgeting tools, financial literacy resources

- Eligibility: Valid US Social Security number, US bank account, and valid government-issued ID

- Fees: Optional tips for advances

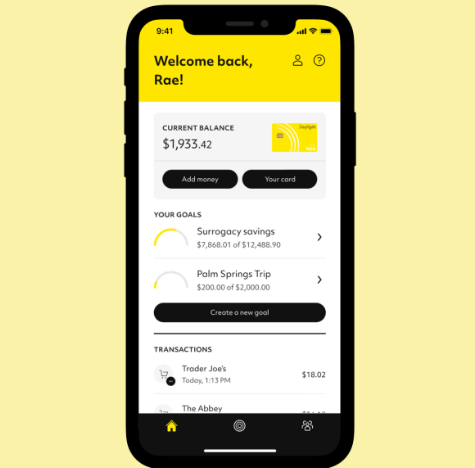

10. Daylight

- Best for: Cash advances with instant approval

- Features: Cash advances up to $250, budgeting tools, financial education resources

- Eligibility: Valid US Social Security number, US bank account, and valid government-issued ID

- Fees: Monthly membership fee ($1), potential transaction fees

11. PayActiv

- Best for: Earned wage access and financial wellness tools

- Features: Access up to 50% of your earned wages

Conclusion

leveraging cash advance apps that work seamlessly with Chime can provide a convenient solution for accessing funds before payday.

These apps offer flexibility, quick access to money, and user-friendly interfaces. However, it’s crucial to be mindful of associated fees and repayment terms. Before opting for any cash advance app, carefully review their terms and conditions, ensuring they align with your financial needs.

While these apps can be valuable tools for managing short-term financial gaps, responsible use and thorough understanding of their features will maximize their benefits while minimizing potential drawbacks.

FAQs about cash advance apps that work with Chime:

- What exactly is Chime, and how does it connect with cash advance apps?

Chime is an online banking platform, and it connects with cash advance apps by allowing users to link their Chime accounts for direct deposits and transactions. - Can I really get money before payday with a Chime-compatible cash advance app?

Yes, many Chime-compatible cash advance apps offer the option to access funds before your regular payday. - What are the fees involved using these cash advance apps?

Fees vary among different cash advance apps. It’s important to review the terms and conditions of each app to understand any associated fees. - How quickly can I access funds with these apps?

The speed of fund access varies by app, but generally, Chime-compatible cash advance apps aim to provide quick access to funds. - Is my financial info safe with these apps?

Reputable cash advance apps prioritize security. Ensure you choose apps with strong security measures and read reviews before connecting them to your Chime account. - Do cash advance apps affect my credit score?

Most cash advance apps don’t conduct a traditional credit check, so using them typically doesn’t impact your credit score. However, it’s essential to verify this with each specific app. - Will Chime SpotMe cover cash advances from these apps?

Chime SpotMe may not cover cash advances from other apps. SpotMe is designed to cover overdrafts on your Chime account. - What’s the maximum advance I can get?

The maximum advance varies by app and is often determined by factors like your income and usage history. Check with the specific cash advance app for their maximum limit. - How often can I use a cash advance app with Chime?

The frequency of using a cash advance app depends on the app’s policies. Some may have daily or weekly limits, so it’s crucial to review their terms. - What happens if I can’t repay the advance in time?

If you can’t repay the advance on time, you may incur additional fees or interest charges. It’s essential to understand the repayment terms and communicate with the cash advance app if you encounter difficulties.